Prodromos Athanassiades was born in 1891 in Poros (Turkish name: Bor), a small town in the Niğde Province of Cappadocia. The name ‘Bodossakis’ by which he was to become known later in his life, is derived from the Turkish equivalent of ‘Prodromos’.

His childhood was one of hardship. At the age of seven, he moved with his family to Mersin, where he attended the local Greek school, establishing himself as the top of his class. He first ventured into business while still at school, providing the Greeks of Mersin with prints featuring heroes of the 1821 Greek Revolution and patriotic pamphlets which were acquired clandestinely from Athens.

When he was17 he rented a watermill and established a flour mill and a ginnery.

In 1912, he married Austrian-born Johanna Gebauer, his life companion for the next 60 years.

His businesses flourished and expanded.

In 1918, he moved to Constantinople. He bought the Pera Palace Hotel in Constantinople and the Sporting Club in Smyrna.

In 1919, while on a visit to Athens, he met Eleftherios Venizelos for the first time.

Prodromos Athanassiades was born in 1891 in Poros (Turkish name: Bor), a small town in the Niğde Province of Cappadocia. The name ‘Bodossakis’ by which he was to become known later in his life, is derived from the Turkish equivalent of ‘Prodromos’.

His childhood was one of hardship. At the age of seven, he moved with his family to Mersin, where he attended the local Greek school, establishing himself as the top of his class. He first ventured into business while still at school, providing the Greeks of Mersin with prints featuring heroes of the 1821 Greek Revolution and patriotic pamphlets which were acquired clandestinely from Athens.

When he was17 he rented a watermill and established a flour mill and a ginnery.

In 1912, he married Austrian-born Johanna Gebauer, his life companion for the next 60 years.

His businesses flourished and expanded.

In 1918, he moved to Constantinople. He bought the Pera Palace Hotel in Constantinople and the Sporting Club in Smyrna.

In 1919, while on a visit to Athens, he met Eleftherios Venizelos for the first time.

In November 1923, true to a promise he had made to Venizelos at Lausanne, Bodossakis settled in Greece and embarked on his business activities there.

In 1934, he took over the Hellenic Powder and Cartridge Company (PYRKAL). As demand for military supplies was particularly high, his company recorded large profits from exports until the start of World War II.

In 1935, he acquired Hellenic Wool Mills Company Ltd. and in early 1937 PYRKAL expanded its munitions production to artillery shells.

In November 1923, true to a promise he had made to Venizelos at Lausanne, Bodossakis settled in Greece and embarked on his business activities there.

In 1934, he took over the Hellenic Powder and Cartridge Company (PYRKAL). As demand for military supplies was particularly high, his company recorded large profits from exports until the start of World War II.

In 1935, he acquired Hellenic Wool Mills Company Ltd. and in early 1937 PYRKAL expanded its munitions production to artillery shells.

The history of the Hellenic Powder and Cartridge Company (PYRKAL) had already begun in 1908, when the small munitions company of the Maltsiniotis Brothers was merged with the Hellenic Powder, Chemical and Industrial Products Company Ltd. In 1924, the Greek government attempted to revive the company with the support of the National Bank of Greece, the Industrial Bank and Bodossakis himself. This attempt, however, failed.

In January 1934, I. Drossopoulos, then Governor of the National Bank of Greece, invited Bodossakis to take over the company. After tough negotiations, the National Bank agreed to transfer to him the ownership of its shares in PYRKAL.

As soon as the agreement had been finalised, Bodossakis started on the revival of PYRKAL. The initial period of the company’s operations, up to the start of World War II, was profitable, as the European countries were all preparing for war and there was great demand for military supplies and munitions. The company also made significant exports to Spain in response to orders placed by the country’s legal government, which at the time was engaged in civil war.

In Greece, however, the Armed Forces had taken a hostile stand towards Bodossakis. The military were questioning the quality of PYRKAL’s products and were quite often purchasing munitions from abroad, even though the company’s products had gained international recognition for their quality. Bodossakis nevertheless kept the company’s production plants operating at full capacity, building up large stocks. This turned out to be a lifesaver when the Greco-Italian War broke out.

In early 1941, when it had become clear that the German invasion of Greece was imminent, Bodossakis was urging the Government to ship PYRKAL’s plant equipment and munitions stock to the Middle East, to prevent them from falling into the hands of the Germans. The approval was eventually given, but it was too late… Once in Athens, the German occupation forces were quick to strip the plant of all its equipment and stock and send everything to Germany.

After the war, PYRKAL resumed operations in 1951, with Greece’s accession to NATO. Relying on the steady flow of NATO orders and at the instigation of Prime Minister Papagos, Bodossakis made significant investments in order to modernise the company, which were completed in 1954.

Yet the post-war period did not bring about the positive results anticipated for PYRKAL. This was partly due to the fact that the use of war material had dropped dramatically after the end of the war, but also to the fact that Greece, as indeed other countries too, was bound by the restrictions of the Cold War era, which meant that its war industry could no longer freely decide on matters concerning the purchase and sale of war material. Besides, state interventionism was also intense, as the Greek State was repeatedly expressing its intention to bring the country’s war industry under its full control.

Finally, after encountering many difficulties in the post-war period, PYRKAL was nationalised in 1981.

The history of the Hellenic Powder and Cartridge Company (PYRKAL) had already begun in 1908, when the small munitions company of the Maltsiniotis Brothers was merged with the Hellenic Powder, Chemical and Industrial Products Company Ltd. In 1924, the Greek government attempted to revive the company with the support of the National Bank of Greece, the Industrial Bank and Bodossakis himself. This attempt, however, failed.

In January 1934, I. Drossopoulos, then Governor of the National Bank of Greece, invited Bodossakis to take over the company. After tough negotiations, the National Bank agreed to transfer to him the ownership of its shares in PYRKAL.

As soon as the agreement had been finalised, Bodossakis started on the revival of PYRKAL. The initial period of the company’s operations, up to the start of World War II, was profitable, as the European countries were all preparing for war and there was great demand for military supplies and munitions. The company also made significant exports to Spain in response to orders placed by the country’s legal government, which at the time was engaged in civil war.

In Greece, however, the Armed Forces had taken a hostile stand towards Bodossakis. The military were questioning the quality of PYRKAL’s products and were quite often purchasing munitions from abroad, even though the company’s products had gained international recognition for their quality. Bodossakis nevertheless kept the company’s production plants operating at full capacity, building up large stocks. This turned out to be a lifesaver when the Greco-Italian War broke out.

In early 1941, when it had become clear that the German invasion of Greece was imminent, Bodossakis was urging the Government to ship PYRKAL’s plant equipment and munitions stock to the Middle East, to prevent them from falling into the hands of the Germans. The approval was eventually given, but it was too late… Once in Athens, the German occupation forces were quick to strip the plant of all its equipment and stock and send everything to Germany.

After the war, PYRKAL resumed operations in 1951, with Greece’s accession to NATO. Relying on the steady flow of NATO orders and at the instigation of Prime Minister Papagos, Bodossakis made significant investments in order to modernise the company, which were completed in 1954.

Yet the post-war period did not bring about the positive results anticipated for PYRKAL. This was partly due to the fact that the use of war material had dropped dramatically after the end of the war, but also to the fact that Greece, as indeed other countries too, was bound by the restrictions of the Cold War era, which meant that its war industry could no longer freely decide on matters concerning the purchase and sale of war material. Besides, state interventionism was also intense, as the Greek State was repeatedly expressing its intention to bring the country’s war industry under its full control.

Finally, after encountering many difficulties in the post-war period, PYRKAL was nationalised in 1981.

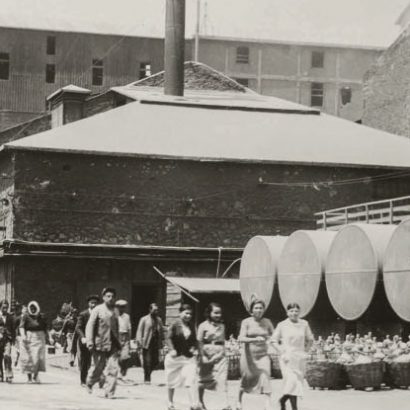

This major industry was founded in 1909, with production facilities located in Patisia.

Initially, production consisted primarily in bedding and military uniforms. This was the period of the Balkan Wars and the company met most of the Greek Army’s requirements for supplies of this kind.

In 1919, the company was converted into a société anonyme (limited liability company), with a share capital of 2 million drachmas.

During the 1929-1931 crisis, the company found itself unable to service the loans it had obtained from the National Bank of Greece and was thus forced to transfer ownership of its shares to the bank. In 1935 PYRKAL, acting on a proposal by Bodossakis, acquired 80% of the National Bank’s stake in Hellenic Wool Mills Company Ltd. After its acquisition by Bodossakis, the company recovered, achieving satisfactory performance levels and evolving into one of the most modern textile industries in the Balkans.

This major industry was founded in 1909, with production facilities located in Patisia.

Initially, production consisted primarily in bedding and military uniforms. This was the period of the Balkan Wars and the company met most of the Greek Army’s requirements for supplies of this kind.

In 1919, the company was converted into a société anonyme (limited liability company), with a share capital of 2 million drachmas.

During the 1929-1931 crisis, the company found itself unable to service the loans it had obtained from the National Bank of Greece and was thus forced to transfer ownership of its shares to the bank. In 1935 PYRKAL, acting on a proposal by Bodossakis, acquired 80% of the National Bank’s stake in Hellenic Wool Mills Company Ltd. After its acquisition by Bodossakis, the company recovered, achieving satisfactory performance levels and evolving into one of the most modern textile industries in the Balkans.

With the onset of the post-war period, Bodossakis resolved to expand his business activity into new areas. An opportunity to do so presented itself in the form of Fertilisers Company Ltd., subsequently renamed Hellenic Chemical Products and Fertilisers S.A. Founded in 1909, the company found itself in dire financial condition as a result of mismanagement.

Bodossakis was quick to realise that the company had good future potential and in October 1946 he bought a majority stake in the company from the founders’ heirs.

At once he determinedly set about rapidly reorganising and developing the company, which at that time owned a superphosphate fertilisers plant in Drapetsona, as well as iron pyrite mines in Chalkidiki which supplied the raw material for the plant. The company also owned copper mines in Cyprus, and consequently Bodossakis founded a new Cypriot company to manage activities locally, as it had been found that operations could not be monitored satisfactorily from Athens.

By 1953, the Bodossakis Group of Companies in Cyprus was providing employment to 3,000 Cypriots. In 1960, Bodossakis donated all his assets in Cyprus to the Cypriot Government, on the understanding that they were to be used for the benefit of the Cypriot people.

The 1950s marked the apex of the company’s growth and prosperity, as Hellenic Chemical Products & Fertilisers S.A. was active in three different sectors of industrial activity, producing numerous products which were sold in Greece and abroad. The company also operated iron pyrite, led, zinc, lignite and chromium mines in a number of different locations throughout Greece.

With the onset of the post-war period, Bodossakis resolved to expand his business activity into new areas. An opportunity to do so presented itself in the form of Fertilisers Company Ltd., subsequently renamed Hellenic Chemical Products and Fertilisers S.A. Founded in 1909, the company found itself in dire financial condition as a result of mismanagement.

Bodossakis was quick to realise that the company had good future potential and in October 1946 he bought a majority stake in the company from the founders’ heirs.

At once he determinedly set about rapidly reorganising and developing the company, which at that time owned a superphosphate fertilisers plant in Drapetsona, as well as iron pyrite mines in Chalkidiki which supplied the raw material for the plant. The company also owned copper mines in Cyprus, and consequently Bodossakis founded a new Cypriot company to manage activities locally, as it had been found that operations could not be monitored satisfactorily from Athens.

By 1953, the Bodossakis Group of Companies in Cyprus was providing employment to 3,000 Cypriots. In 1960, Bodossakis donated all his assets in Cyprus to the Cypriot Government, on the understanding that they were to be used for the benefit of the Cypriot people.

The 1950s marked the apex of the company’s growth and prosperity, as Hellenic Chemical Products & Fertilisers S.A. was active in three different sectors of industrial activity, producing numerous products which were sold in Greece and abroad. The company also operated iron pyrite, led, zinc, lignite and chromium mines in a number of different locations throughout Greece.

KEO Distilleries Ltd. was founded in 1906 and was acquired by Bodossakis in 1947. Renamed Hellenic Wines & Spirits S.A. (VOTRYS), the company at once proceeded to fully reorganise its operations, renew its equipment and establish a brewery, which was officially opened in 1951.

In its plants in Athens and Elefsina, the company operated distillery, winery, beverages, distillates and brewery departments.

The company’s exports of wines, beverages and distillates to Western Europe and North America in the period 1974-1979 stood at approximately $12 million.

KEO Distilleries Ltd. was founded in 1906 and was acquired by Bodossakis in 1947. Renamed Hellenic Wines & Spirits S.A. (VOTRYS), the company at once proceeded to fully reorganise its operations, renew its equipment and establish a brewery, which was officially opened in 1951.

In its plants in Athens and Elefsina, the company operated distillery, winery, beverages, distillates and brewery departments.

The company’s exports of wines, beverages and distillates to Western Europe and North America in the period 1974-1979 stood at approximately $12 million.

Bodossakis launched this large-scale, visionary project in 1955, yet he did not enjoy the fruits of his labours. Having said that, this initiative gives a measure of his drive, creativity and imagination as an entrepreneur. The project involved the exploitation of the lignite-rich area of Ptolemaida, with the creation of a power plant and other industries that would use lignite as raw material (e.g. nitrogenous fertilisers).

For this purpose, Bodossakis created the company Ptolemais Lignite Mines S.A. (LIPTOL) and embarked on the great venture he had undertaken. Speaking during the inauguration ceremony held in 1957, Bodossakis declared: “This project is the cornerstone of the future development of the country’s economy.”

Unfortunately, over the following years he was obliged as a result of various interventions to transfer his ownership rights to the Greek State, and ultimately to the PPC. With justified bitterness, Bodossakis wrote: ‘This is a project which, were it not for my own personal initiative, my own labours, my own connections and my own funds, would have never been possible.’

Bodossakis launched this large-scale, visionary project in 1955, yet he did not enjoy the fruits of his labours. Having said that, this initiative gives a measure of his drive, creativity and imagination as an entrepreneur. The project involved the exploitation of the lignite-rich area of Ptolemaida, with the creation of a power plant and other industries that would use lignite as raw material (e.g. nitrogenous fertilisers).

For this purpose, Bodossakis created the company Ptolemais Lignite Mines S.A. (LIPTOL) and embarked on the great venture he had undertaken. Speaking during the inauguration ceremony held in 1957, Bodossakis declared: “This project is the cornerstone of the future development of the country’s economy.”

Unfortunately, over the following years he was obliged as a result of various interventions to transfer his ownership rights to the Greek State, and ultimately to the PPC. With justified bitterness, Bodossakis wrote: ‘This is a project which, were it not for my own personal initiative, my own labours, my own connections and my own funds, would have never been possible.’

Chemical Industries of Northern Greece S.A. was founded in 1962 and its shareholders were Hellenic Chemical Products & Fertilisers S.A., the National Bank of Greece and the French Rhône-Poulenc Group. The company’s plant in Diavata, Thessaloniki, began operating in 1966, producing acids, fertilisers and propulsion gases (for use in aerosol dispensers and refrigeration installations).

As soon as production was under way, the company also began to export its products, primarily propulsion gases and small quantities of fertilisers, as most global production of the latter served to meet domestic needs. For the period 1974-1979, the company’s exports stood in excess of $60 million.

Chemical Industries of Northern Greece S.A. was founded in 1962 and its shareholders were Hellenic Chemical Products & Fertilisers S.A., the National Bank of Greece and the French Rhône-Poulenc Group. The company’s plant in Diavata, Thessaloniki, began operating in 1966, producing acids, fertilisers and propulsion gases (for use in aerosol dispensers and refrigeration installations).

As soon as production was under way, the company also began to export its products, primarily propulsion gases and small quantities of fertilisers, as most global production of the latter served to meet domestic needs. For the period 1974-1979, the company’s exports stood in excess of $60 million.

On 16 July 1952, the Greek State concluded with Hellenic Chemical Products and Fertilisers S.A. an agreement granting the company a 36-year long lease of ownership and exploitation rights in the nickel mines in the Larymna area.

During the first ten years of operation of the Larymna mines, exploration and exploitation of the deposits was quite satisfactory and even exceeded the company’s contractual obligations. However, with regard to the metallurgical treatment of the ores to produce nickel, the opposite was the case, as despite all their efforts the Krupp-Renn method initially used in the production of ferro-nickel with a nickel content of 5% resulted in failure and was ultimately abandoned altogether, but not before it had produced over $25 million of losses for the company.

This was followed by negotiations for the sale of the mines to Inco Limited, the Canadian mining company and world leader in nickel production, which however were abandoned for good in June 1961. Almost immediately after that, interest in the mines was again expressed by a French company, this time the nickel mining company Le Nickel. On 31 July 1961, a protocol was signed for the establishment of a new company, in which Le Nickel would participate with 21.5%. The name agreed for the new company was General Mining and Metallurgical Company S.A. (LARCO).

Le Nickel’s involvement in LARCO lasted until 1968, when the French withdrew. During this time, however, Bodossakis had successfully secured the transfer of know-how to the Larymna Metallurgy Department.

LARCO was thus able to continue on its successful path moving forward, with nickel production growing from 109 tonnes in 1966 to over 2,300 in 1967, rising steadily thereafter and reaching 16,500 tonnes in 1976 – a record annual production volume for the entire period, before the large investment made during 1977-1978 to increase the plant’s capacity. Bodossakis’ faith in the Larymna business venture and his endeavours to ensure its success were thus vindicated.

On 16 July 1952, the Greek State concluded with Hellenic Chemical Products and Fertilisers S.A. an agreement granting the company a 36-year long lease of ownership and exploitation rights in the nickel mines in the Larymna area.

During the first ten years of operation of the Larymna mines, exploration and exploitation of the deposits was quite satisfactory and even exceeded the company’s contractual obligations. However, with regard to the metallurgical treatment of the ores to produce nickel, the opposite was the case, as despite all their efforts the Krupp-Renn method initially used in the production of ferro-nickel with a nickel content of 5% resulted in failure and was ultimately abandoned altogether, but not before it had produced over $25 million of losses for the company.

This was followed by negotiations for the sale of the mines to Inco Limited, the Canadian mining company and world leader in nickel production, which however were abandoned for good in June 1961. Almost immediately after that, interest in the mines was again expressed by a French company, this time the nickel mining company Le Nickel. On 31 July 1961, a protocol was signed for the establishment of a new company, in which Le Nickel would participate with 21.5%. The name agreed for the new company was General Mining and Metallurgical Company S.A. (LARCO).

Le Nickel’s involvement in LARCO lasted until 1968, when the French withdrew. During this time, however, Bodossakis had successfully secured the transfer of know-how to the Larymna Metallurgy Department.

LARCO was thus able to continue on its successful path moving forward, with nickel production growing from 109 tonnes in 1966 to over 2,300 in 1967, rising steadily thereafter and reaching 16,500 tonnes in 1976 – a record annual production volume for the entire period, before the large investment made during 1977-1978 to increase the plant’s capacity. Bodossakis’ faith in the Larymna business venture and his endeavours to ensure its success were thus vindicated.

Hellenic Owens Elefsis Glass Company S.A. was founded around 1970, on Bodossakis’s own initiative. The company’s shareholders were the Bodossakis companies with a 65% stake (LARCO with 32.5%, Hellenic Chemical Products & Fertilisers with 25.5% and PYRKAL with 7%), the Hellenic Bank for Investments and Industrial Development (ETEVA) with 10%, and OWENS ILLINOIS S.A. with the remaining 25%.

With a daily output capacity of 240 tonnes, the company’s plant produced bottles suitable for bottling liquors, beverages, pharmaceuticals and other liquid products, as well as glasses and other tableware.

A significant part of production (15%-20%) was exported primarily to Egypt, Libya and other countries in the Middle East. From $280,000 in 1974, the value of the company’s exports grew to $1.4 million in 1979 and $3 million in 1980.

Hellenic Owens Elefsis Glass Company S.A. was founded around 1970, on Bodossakis’s own initiative. The company’s shareholders were the Bodossakis companies with a 65% stake (LARCO with 32.5%, Hellenic Chemical Products & Fertilisers with 25.5% and PYRKAL with 7%), the Hellenic Bank for Investments and Industrial Development (ETEVA) with 10%, and OWENS ILLINOIS S.A. with the remaining 25%.

With a daily output capacity of 240 tonnes, the company’s plant produced bottles suitable for bottling liquors, beverages, pharmaceuticals and other liquid products, as well as glasses and other tableware.

A significant part of production (15%-20%) was exported primarily to Egypt, Libya and other countries in the Middle East. From $280,000 in 1974, the value of the company’s exports grew to $1.4 million in 1979 and $3 million in 1980.

The death of Bodossakis on 18 January 1979, brought a versatile, multifaceted and productive life to an end. However the acts of charity which he had quietly carried out throughout his long life did not end with his passing; they are continued to this day by the Bodossaki Foundation, his last and most important ‘child’, as he used to say with a smile.

Bodossakis Athanassiades proved himself a worthy inheritor of the nation’s long tradition of great benefactors. In the modern history of Greece he is rightly counted as being one of their number.

The secret of Bodossakis’ success was his love of creation, not of money. The fact that while he was still alive and fully active as an entrepreneur, he bequeathed his entire fortune to the Bodossaki Foundation, demonstrated the fact that his purpose in life had always been to express his creativity and simultaneously to support the Greek state and his fellow Greeks.

The death of Bodossakis on 18 January 1979, brought a versatile, multifaceted and productive life to an end. However the acts of charity which he had quietly carried out throughout his long life did not end with his passing; they are continued to this day by the Bodossaki Foundation, his last and most important ‘child’, as he used to say with a smile.

Bodossakis Athanassiades proved himself a worthy inheritor of the nation’s long tradition of great benefactors. In the modern history of Greece he is rightly counted as being one of their number.

The secret of Bodossakis’ success was his love of creation, not of money. The fact that while he was still alive and fully active as an entrepreneur, he bequeathed his entire fortune to the Bodossaki Foundation, demonstrated the fact that his purpose in life had always been to express his creativity and simultaneously to support the Greek state and his fellow Greeks.